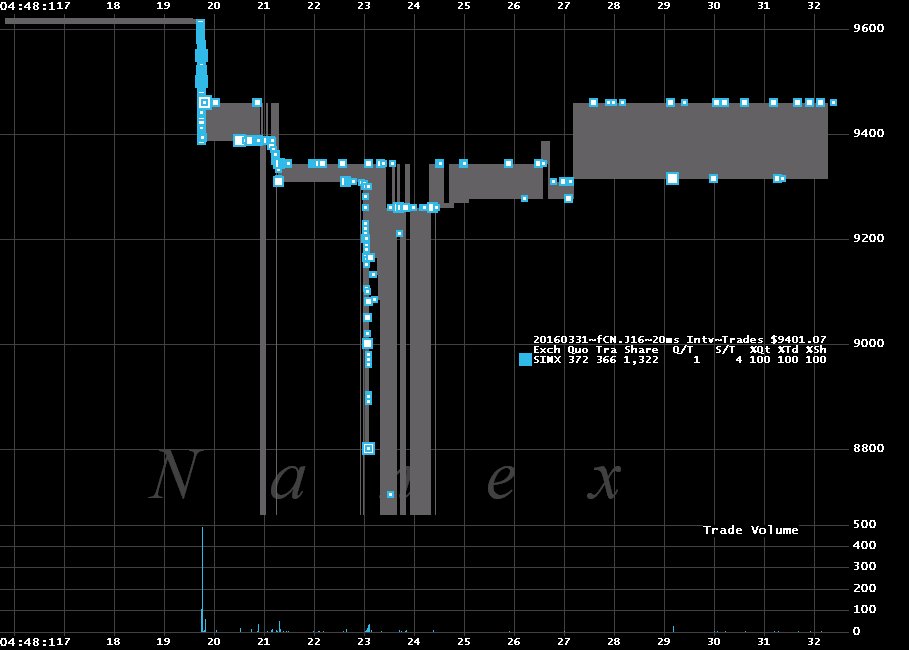

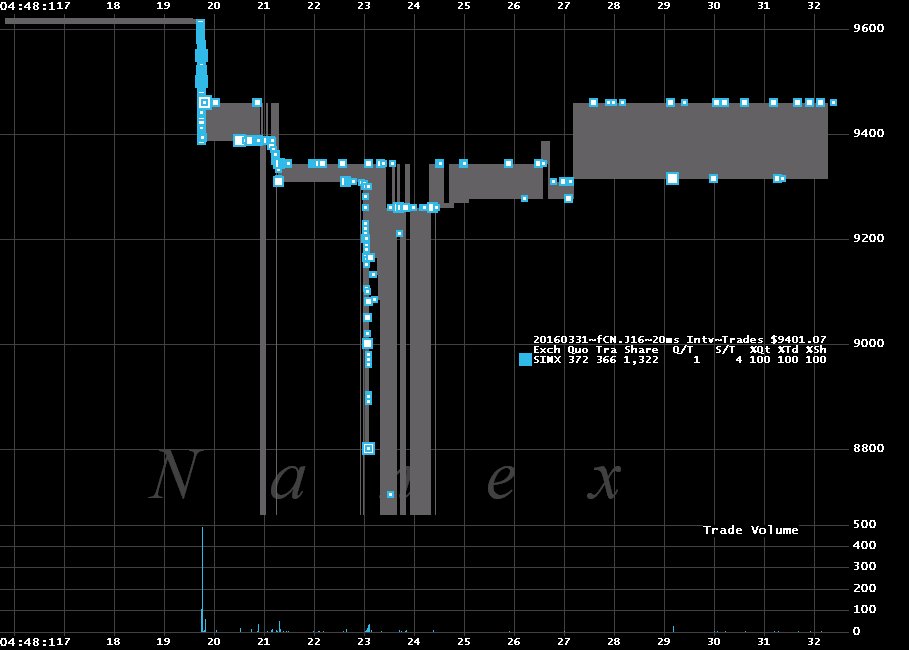

plus un flash krach sur le future a50 chinois

9610 at 04:48:19 down to 8712 at 04:48:23

| Forum-Gold.fr http://forum-gold.fr/ |

|

| Krach boursier en Chine ? http://forum-gold.fr/viewtopic.php?f=14&t=17409 |

Page 14 sur 14 |

| Auteur: | silvermath [ 31 Mar 2016 11:35 ] |

| Sujet du message: | Re: Krach boursier en Chine ? |

*CHINA AA- RATING OUTLOOK CHANGED TO NEGATIVE FROM STABLE AT S&P |

|

| Auteur: | silvermath [ 31 Mar 2016 11:47 ] |

| Sujet du message: | Re: Krach boursier en Chine ? |

S&P: RISKS TO CHINA GOVT CREDITWORTHINESS GRADUALLY INCREASING |

|

| Auteur: | silvermath [ 31 Mar 2016 11:53 ] |

| Sujet du message: | Re: Krach boursier en Chine ? |

Tiens tiens ça chauffe Citer: HK OVERNIGHT INTERBANK OFFERED RATE FOR OFFSHORE YUAN (CNH HIBOR) PLUNGES 4.77 % TO -3.725%, 1st TIME IN NEGATIVE TERRITORY ON RECORD

|

|

| Auteur: | silvermath [ 31 Mar 2016 11:55 ] |

| Sujet du message: | Re: Krach boursier en Chine ? |

plus un flash krach sur le future a50 chinois  9610 at 04:48:19 down to 8712 at 04:48:23 |

|

| Auteur: | silvermath [ 31 Mar 2016 12:02 ] |

| Sujet du message: | Re: Krach boursier en Chine ? |

rappel

|

|

| Auteur: | silvermath [ 24 Mai 2017 10:42 ] |

| Sujet du message: | Re: Krach boursier en Chine ? |

Moody's cuts China's rating on debt fears http://sg.news.yahoo.com/moodys-cuts-ch ... nance.html Citer: Moody's on Wednesday slashed China's credit rating for the first time in almost three decades citing concerns about the country's rising debt and slowing growth, but Beijing rejected the downgrade as "inappropriate".

The move comes as China tries to clean up a toxic brew of unregulated and risky lending that for years has fuelled the economy's spectacular growth, though some analysts doubt Beijing's willingness to quit its debt addiction. "The downgrade reflects Moody's expectation that China's financial strength will erode somewhat over the coming years, with economy-wide debt continuing to rise as potential growth slows," the agency said. China's total outstanding credit surged to 260 percent of gross domestic product (GDP) by the end of 2016 and the International Monetary Fund has warned that a debt crisis in the country could "imperil global financial stability". The government has trimmed its 2017 growth target to around 6.5 percent after it expanded 6.7 percent in 2016, the slowest growth rate since 1990. China's 13th Five-Year-Plan released in 2016 announced an average annual growth rate of above 6.5 percent for 2016-2020. But Moody's said it expects China's growth potential to decline to close to five percent over the next five years, citing diminishing investment, an accelerated fall in the working age population and a continuing dip in productivity. - 'Cold water' - The finance ministry rejected the assessment, saying Moody's had used an "inappropriate" method to assess the risks facing the economy. "It over-estimated the difficulties that the Chinese economy is facing," the ministry said in a statement. It added that the government’s debt ratio in 2016 was 36.7 percent, lower than major market economies, and that the “expansion of the scale of government debt has been effectively controlled”. "The downgrade will certainly affect China negatively," Liao Qun, Hong Kong-based chief economist of Citic Bank International, told AFP. "The direct impact is that this would make China's debt financing more difficult and the financing cost would also rise. "This is like throwing cold water when everyone is optimistic about China's economy." But Liao said the move "makes no sense" because China's growth has improved from last year and the threat of trade protectionism from US President Donald Trump's administration has subsided. Moody's cut the long-term local currency and foreign currency issuer ratings to A1 from Aa3, the first reduction since late 1989 as it assessed the impact of the Tiananmen Square crackdown on China's trade with the world. However, Moody's upgraded its outlook to stable from negative, where it had been since March 2016. "The stable outlook reflects our assessment that, at the A1 rating level, risks are balanced," it said in its ratings note. "The erosion in China's credit profile will be gradual and, we expect, eventually contained as reforms deepen," Moody's said. - Crisis fears - "The strengths of its credit profile will allow the sovereign to remain resilient to negative shocks, with GDP growth likely to stay strong compared to other sovereigns, still considerable scope for policy to adapt to support the economy, and a largely closed capital account." Fears are mounting that China is flirting with a potential disaster worse than the US sub-prime collapse that sparked the global financial crisis, and Japan's 1990s asset-bubble meltdown and resulting "lost decade". China's banking regulator recently unveiled measures to rein in dangerous lending, tighten balance sheets and strengthen institutional transparency and chronically weak internal controls. Moody's had estimated in October that China's "shadow banking" sector -- off-balance-sheet lending that evades official risk supervision -- totalled $8.5 trillion, or nearly 80 percent of GDP. But analysts have expressed scepticism about whether Beijing will back up its talk with real action since freewheeling credit conditions have underpinned the growth China's Communist Party relies on for political legitimacy. "It is not going to come as any great news to the world that China has problems with a huge credit boom that, in the end, is probably going to require government intervention to bear some of the costs," Richard Jerram, chief economist at Bank of Singapore, told Bloomberg News. Shanghai and Hong Kong stocks fell son after the downgrade was announced but rebounded in the afternoon to end slightly higher. |

|

| Auteur: | numismachin [ 24 Mai 2017 10:50 ] |

| Sujet du message: | Re: Krach boursier en Chine ? |

En français et en bref, ça dit quoi? |

|

| Auteur: | Argentum Aurum [ 24 Mai 2017 10:57 ] |

| Sujet du message: | Krach boursier en Chine, yuan, bitcoin et or |

http://www.argentum-aurum.com/chine-hausse-du-bitcoin-et-chutes-de-la-bourse-et-du-yuan/ C'est en français! |

|

| Auteur: | picsou [ 24 Mai 2017 23:05 ] |

| Sujet du message: | Re: Krach boursier en Chine ? |

http://www.lemonde.fr/economie/article/ ... _3234.html Citer: Moody’s dégrade la Chine pour la première fois depuis 1989 ceci n'a eu aucune incidence aujourd'hui pour les indices US puisque le Dow Jones reste sur ses sommets https://www.romandie.com/news/Wall-Stre ... 799181.rom Citer: "Ce qui est intéressant, ce n'est pas ce qui se passe sur le marché, mais ce qui ne se passe pas", a estimé Gregori Volokhine, de Meeschaert Financial Services. "En ce moment, il se passe des tas de choses, que ce soit politique, géopolitique, économique, et on voit que rien n'a d'emprise sur les marchés financiers", a-t-il insisté, citant notamment un abaissement de la notation de la Chine par l'agence Moody's. venant de Gregori Volokhine c'est presque comique |

|

| Page 14 sur 14 | Heures au format UTC + 1 heure [ Heure d’été ] |

| Powered by phpBB © 2000, 2002, 2005, 2007 phpBB Group http://www.phpbb.com/ |

|